Files API

PaymentsPlus uses files to group payments to be processed. A file can contain payments of various methods. When a file is submitted for processing, all payments within the file are submitted at the same time.

Use this resource to:

Creating Files and Payments

There are two ways to create files in the PaymentsPlus API.

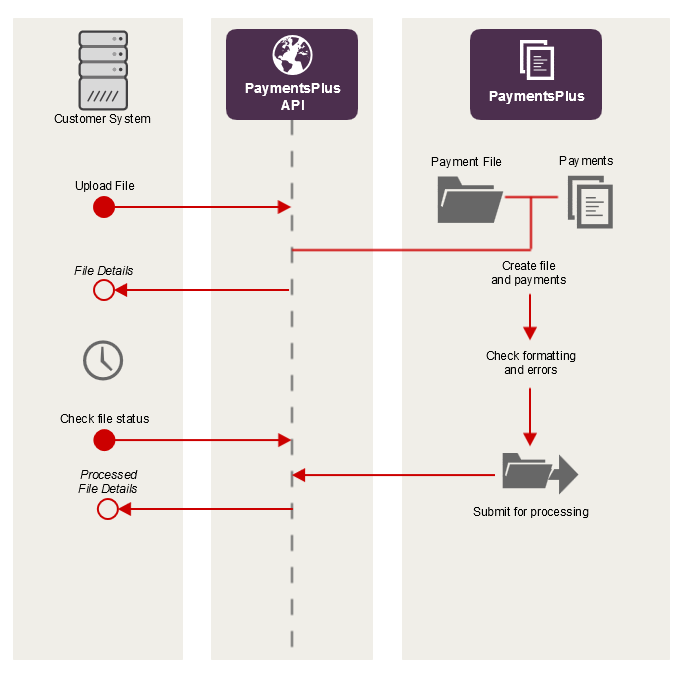

Upload a File

The most basic form of file creation is to POST a physical file of payments using the Upload Payment File resource. The file formats that are supported through the API are:

Once a file has been uploaded it will be checked for errors and formatting issues and will then be submitted for processing. The details of the file will be returned from the resource when a file is uploaded, and this can be used to poll for the status of the file. Files may take a few minutes to process depending on the number of payments in the file.

Example

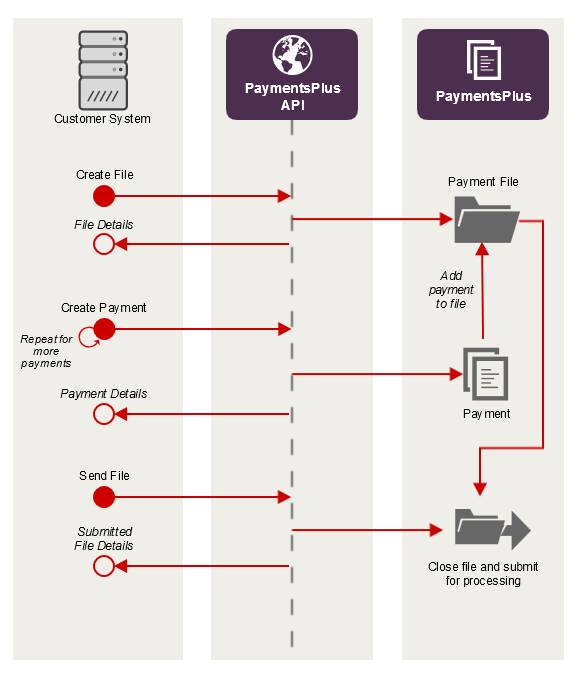

Create a File

The other method of creating files and payments in the PaymentsPlus API is to call the Create File resource and to create/open a file and then call Create Payment to add payments to the file.

Once all the payments have been added to the file, the file can be sent. The file is then sent and the payments processed.

Example

List recent files

Request

GET /files

Request body

None.

Response

This is a paginated resource. The most recent file is first.

| Field | Format | Data |

|---|---|---|

links |

Array of Links | Links to related documents and pagination. |

data |

Array of File Model | A paginated list of files. |

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

Create file

Create a Payment File to add Payments to. Later you need to call Send to submit the file.

If this resource is called again with the same values, no new file will be created. If any values are different the file will be updated to reflect these different values.

Only files that are in an OPEN state can be modified this way.

Request

PUT /files/{fileIdentifier}

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. Maximum 20 characters. |

Request body

| Field | Format | Length | Required | Description |

|---|---|---|---|---|

fileName |

string |

1-256 | Required | The filename to help identify the file. |

paymentDate |

string |

Required | The payment date of the file. In the format YYYY-MM-DD. | |

referenceCode |

string |

0-20 | Optional | A additional reference code for the file. |

Response

If successful, this method returns a File Model in the response body.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

422 |

UNPROCESSABLE ENTITY | This is returned when the file is not in an OPEN state or if there is an Error. |

Get file

Get the file details.

Request

GET /files/{fileIdentifier}

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

Request body

None.

Response

If successful, this method returns a File Model in the response body.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

404 |

NOT FOUND | The fileIdentifier path parameter may be incorrect. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

Send file

Send a file for processing. This resource will close and file and send it for processing. All payments within the file will be processed.

Once a file has been sent no further actions can such as modifying or cancelling can be performed.

Request

POST /files/{fileIdentifier}/send

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

Request body

None.

Response

If successful, this method returns a File Model in the response body for the file that was just sent.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

Cancel file

CANCEL a file. This resource can be used to mark a file as cancelled so it will not be processed.

Only files in an OPEN state can be cancelled in this way.

Request

POST /files/{fileIdentifier}/cancel

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

Request body

None.

Response

If successful, this method returns a File Model in the response body with the updated status for the file.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

422 |

UNPROCESSABLE ENTITY | This is returned when the file is not in an OPEN state. |

Upload payment file

To upload a payment file, you must:

- Create a file in the one of the Payment Import formats

- Australian payment import CSV

- New Zealand payment import CSV

- ISO 20022 pain001.001.03

- Encode your

POSTasmultipart/form-datausing curl or a standard library. - In the multipart request send a field named

filewith a unique filename

Request

POST /files/{fileIdentifier}/upload

Request headers

| Header | Description |

|---|---|

Prevent-CSRF |

Set to true. Required. This header is required for multipart requests to prevent Cross-Site Request Forgery |

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. Maximum 20 characters. |

Request body

Encode your POST as multipart/form-data. Provide the file contents in the multipart binary part. Provide the following in the multipart request part:

| Field | Format | Description |

|---|---|---|

file |

string |

Unique file name. |

Response

If successful, this method returns the File Mode; in the response body.

HTTP status codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

201 |

CREATED | The file is stored. Quickstream will check the format of the file and then process transactions. You must check the status of the file. |

400 |

BAD REQUEST | Prevent-CSRF header is missing or is not set to true. |

422 |

UNPROCESSABLE ENTITY | The request contained invalid data or the server has detected a duplicate payment file. Refer to errors in the response body for more. View more |

Duplicate checking

This API returns a 422 UNPROCESSABLE ENTITY when it detects a duplicate payment file. A payment file with the same name and hashed message contents indicates a duplicate.

List by filename

List files by File Name. Use this resource to find files by File Name

Request

GET /files/for-filename?filename={string}

Query parameters

| Parameter Name | Format | Description |

|---|---|---|

filename |

string |

Get a list of files for the provided File Name. |

Request body

None.

Response

This is a paginated resource. The most recent file is first.

| Field | Format | Data |

|---|---|---|

links |

Array of Links | Links to related documents and pagination. |

data |

Array of File Model | A paginated list of files. |

HTTP status codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | The request has succeeded. |

401 |

UNAUTHORIZED | The API key in the request is expired. View more. |

422 |

UNPROCESSABLE ENTITY | reference contains non-ASCII characters or is empty. View more. |

List by date

List files by payment date. Use this resource to find files for a given payment date.

Request

GET /files/for-date?date={string}

Query parameters

| Parameter Name | Format | Description |

|---|---|---|

date |

string |

Get a list of files for the provided Reference Code or File Name. In the format YYYY-MM-DD. |

Request body

None.

Response

This is a paginated resource. The most recent file is first.

| Field | Format | Data |

|---|---|---|

links |

Array of Links | Links to related documents and pagination. |

data |

Array of File Model | A paginated list of files. |

HTTP status codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | The request has succeeded. |

401 |

UNAUTHORIZED | The API key in the request is expired. View more. |

422 |

UNPROCESSABLE ENTITY | date contains non-ASCII characters or is empty. View more. |

List by status

List files by status code. Use this resource to find files for a given status code. You can use the following codes:

| Status Code | Description |

|---|---|

| PENDING | The file is pending processing. |

| FORMAT_CHECK | The file is being validated and checked for correctness. |

| VALIDATED | The file has been validated and is correct. |

| ERROR | There was an error in the file. |

| AUTH_REQUIRED | The file requires an authorisation through the PaymentsPlus portal to be processed. |

| SECOND_AUTH_REQUIRED | This file requires a second authorisaction through the PaymentsPlus portal to be processed. |

| CANCELLED | The file has been cancelled and will not be processed. |

| PROCESSING | The file is currently processing. |

| COMPLETE | The file has completed processing. |

| POSSIBLE_DUPLICATE | This file may be a duplicate and has been held for processing. |

Request

GET /files/for-status?status={string}

Query parameters

| Parameter Name | Format | Description |

|---|---|---|

status |

string |

Get a list of files for the provided Status code listed above. |

Request body

None.

Response

This is a paginated resource. The most recent file is first.

| Field | Format | Data |

|---|---|---|

links |

Array of Links | Links to related documents and pagination. |

data |

Array of File Model | A paginated list of files. |

HTTP status codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | The request has succeeded. |

401 |

UNAUTHORIZED | The API key in the request is expired. View more. |

422 |

UNPROCESSABLE ENTITY | status contains non-ASCII characters or is empty. View more. |

Get payments in a file

Get a list of the payments that are in a specified file.

Request

GET /files/{fileIdentifier}/payments

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

Request body

None.

Response

This is a paginated resource.

| Field | Format | Data |

|---|---|---|

links |

Array of Links | Links to related documents and pagination. |

data |

Array of Payment Response Model | A paginated list of files. |

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

404 |

NOT FOUND | The fileIdentifier path parameter may be incorrect. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

Create payment

Create a Payment under a file. Later you need to call Send to submit the file this payment is in.

If this resource is called again with the same values, no new payment will be created. If any values are different the payment will be updated with these new values.

Only files that are in an OPEN state can have payments added to them.

Request

PUT /files/{fileIdentifier}/payments/{paymentIdentifier}

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

paymentIdentifier |

string |

The code that uniquely identifies the payment. Maximum 20 characters. |

Request body

| Field | Format | Length | Required | Description |

|---|---|---|---|---|

paymentMethod |

string |

Required | The payment method code for the payment to use. See Payment Methods. | |

paymentAmount |

decimal |

Required | The amount of the payment. | |

paymentDate |

string |

Required | The date the payment should be made. In the format yyyy-MM-dd | |

fundingAccount |

A Funding Account Request Model | Optional | The account that the payment will be made from. This account must be usable for the provided paymentMethod. If no funding account is provided the default for the provided paymentMethod and currency will be used. DIRECT_ENTRY payments use the funding account name as the remitter name. |

|

recipientAccount |

A Recipient Account Request Model | Required | The account that the payment will be made to. This account must be usable for the provided paymentMethod |

|

payeeName |

string |

1-140 | Required | The payee name for the payment |

currency |

string |

3 | Required | The currency the payment will be made in. |

lodgementReference |

string |

1-18 | Required* | The lodgement reference for the payment. *This field is not allowed for BPAY. |

paymentReference |

string |

0-35 | Optional | The payer reference for the payment. One will be generated if not provided. |

payeeRegisteredAddress |

A Payee Registered Address Request Model | Optional | The address of the payee. This is required for OTT. | |

chargeBearer |

string |

0-4 | Optional | The international charge bearer code to apply to this transaction. Available values are SHA - Fees shared between payer and beneficiary and OUR - Fees paid by ordering customer (payer). Note This is only available as part of a premium solution, this feature needs to be agreed and enabled by Westpac Implementation before use. If the feature is not enabled before processing it is ignored and the facility default will be used instead |

remitterName |

string |

0-16 | Optional | The remitter name to use with Australian EFT payments (only). If a name is not provided, the current account default will be used. |

Response

If successful, this method returns a Payment Response Model in the response body.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

422 |

UNPROCESSABLE ENTITY | This is returned when the file is not in an OPEN state or if there is an Error. |

Lodgement Reference Restrictions

| Payment Channel | Reference Name | Min/Max Length | Format | Description |

|---|---|---|---|---|

| Direct Entry (EFT) | Recipient Reference (Lodgement Reference) | 1/18 | Alphanumeric | This will be the lodgement reference that appears on the payee's bank statement. It is recommended that this value be unique for each payment. Invalid characters will be removed. |

| RTGS | Recipient Reference (Lodgement Reference) | 1/16 | Alphanumeric | This reference will be included as part of the credit transaction data appearing on the payee bank statement as WBC PAYPLUS-<Reference>. <Reference> may be truncated by the receiving bank. It is recommended that this value be unique for each payment. |

| OTT | Recipient Reference | 1/16 | Alphanumeric | This reference will be included as part of the credit transaction data appearing on the payee bank statement as WBC PAYPLUS-<Reference>. <Reference> may be truncated by the receiving bank. It is recommended that this value be unique for each payment. |

Get payment

Get the file details.

Request

GET /files/{fileIdentifier}/payments/{paymentIdentifier}

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

paymentIdentifier |

string |

The code that uniquely identifies the payment. |

Request body

None.

Response

If successful, this method returns a Payment Response Model in the response body.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

404 |

NOT FOUND | The fileIdentifier path parameter may be incorrect. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

Cancel payment

CANCEL a payment. This resource can be used to mark a payment as rejected so it will not be processed.

Only payments that are in an OPEN state can be cancelled.

Request

POST /files/{fileIdentifier}/payments/{paymentIdentifier}/cancel

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

paymentIdentifier |

string |

The code that uniquely identifies the payment. |

Request body

None.

Response

If successful, this method returns a Payment Response Model in the response body with the updated status for the file.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | Authorisation succeeded and your software/network can access the API. |

401 |

UNAUTHORIZED | Authorisation failed. View more. |

403 |

FORBIDDEN | Your facility may not be set up. View more. |

407 |

PROXY AUTHENTICATION REQUIRED | This error is returned by your proxy server, not PaymentsPlus. You need to configure a proxy username and password in order to access the internet. |

422 |

UNPROCESSABLE ENTITY | This is returned when the payment is not in an OPEN state. |

Get a PAIN002 response file

Get a PAIN002 response message associated with a file. This end point is only applicable on files that were originally loaded as PAIN001 files.

See ISO Payables for more information.

Request

GET /files/{fileIdentifier}/pain002.001.03?type={type}

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

Query parameters

| Parameter Name | Format | Description |

|---|---|---|

type |

string |

The type of the response file to be returned. One of ACK, SF, LF. |

Request body

None.

Response

If successful, this method returns the XML content of the PAIN002.001.03 file. See PAIN002.001.03

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | The request has succeeded and the report will download. |

404 |

NOT FOUND | One of:

|

406 |

NOT ACCEPTABLE | The Accept header must be application/xml, test/xml, or blank. |

Get a CSV response file

Get a CSV response message associated with a file.

See Response File Format for more information.

Request

GET /files/{fileIdentifier}/response?type={type}

Path parameters

| Parameter Name | Format | Description |

|---|---|---|

fileIdentifier |

string |

The code that uniquely identifies the file. |

Query parameters

| Parameter Name | Format | Description |

|---|---|---|

type |

string |

The type of the response file to be returned. Currently only CSV is supported. |

Request body

None.

Response

If successful, this method returns the xml content of the CSV response file. See Response File Formats for more.

HTTP Status Codes

See HTTP Status Codes for more.

| Status Code | Description | More information |

|---|---|---|

200 |

OK | The request has succeeded and the report will download. |

404 |

NOT FOUND | One of:

|

406 |

NOT ACCEPTABLE | The Accept header must be text/csv, or blank. |

File Model

| Field | Format | Description |

|---|---|---|

links |

Array of Links | Links to related documents and resources. |

fileIdentifier |

string |

The file identifier used in API calls. |

statusCode |

string |

The status of the file. See File status codes. |

receiptStatus |

string |

The receipt status of the file. See File receipt status codes. |

fileName |

string |

The name of the file submitted. |

referenceCode |

string |

The reference code of the file. |

paymentDate |

string |

The payment date of the file. In the format YYYY-MM-DD |

fileSummaries |

Array of File Summaries | A collection of summaries of the file grouped by currency. |

errors |

Array of Errors | Any errors that were found when processing the file. |

For example:

{

"links": [],

"fileIdentifier": "123456789",

"statusCode": "COMPLETE",

"receiptStatus":"AWAITING_CLEARANCE",

"fileName": "PaymentFile.csv",

"referenceCode": "REF123456",

"paymentDate": "2018-01-15",

"fileSummaries": [],

"errors": []

}File Summary Model

| Field | Format | Description |

|---|---|---|

methodCode |

string |

The code that represents the Payment Method that the payments are for. |

currency |

string |

The currency of the file sumamry. |

acceptedCount |

number |

The number of accepted payments. |

acceptedAmount |

decimal |

The amount of the accepted payments. |

rejectedCount |

number |

The number of rejected payments. |

rejectedAmount |

decimal |

The amount of the rejected payments. |

For example:

{

"methodCode": "DIRECT_ENTRY",

"currency": "AUD",

"acceptedCount": 1,

"acceptedAmount": 100.00,

"rejectedCount": 1,

"rejectedAmount": 10.00

}File Error Model

| Field | Format | Description |

|---|---|---|

location |

string |

The line location of the error. |

fieldName |

string |

The name of the error field. |

fieldValue |

string |

The value that was provided in the field. |

errorCode |

string |

The code of the specific error. |

errorDescription |

string |

Description of the error. |

message |

string |

Message detailing the error. |

For example:

{

"location": "Line 1",

"fieldName": "Version",

"fieldValue": "N",

"errorCode": "F01",

"errorDescription": "Invalid value.",

"message": "Invalid file version."

}Funding Account Request Model

Australian Accounts

| Field | Format | Required | Description |

|---|---|---|---|

bsbNumber |

string |

Required | The BSB. |

accountNumber |

string |

Required | The account number. |

For example:

{

"bsbNumber": "032-000",

"accountNumber": "100001"

}New Zealand Accounts

| Field | Format | Required | Description |

|---|---|---|---|

bankCode |

string |

Required | The Bank Code. |

branchCode |

string |

Required | The Branch Code. |

accountNumber |

string |

Required | The Account Number. |

accountSuffix |

string |

Required | The Account Suffix. |

For example:

{

"bankCode": "03",

"branchCode": "2000",

"accountNumber": "100001",

"accountSuffix": "00"

}Recipient Account Request Model

Different types of recipient accounts include different values.

BPay Account

| Field | Format | Required | Description |

|---|---|---|---|

type |

string |

Required | The type of the account. BPAY |

billerNumber |

string |

Required | The biller number. |

crn |

string |

Required | The customer reference number of the account. |

For example

{

"type": "BPAY",

"billerNumber": "123456",

"crn": "12345678"

}International Account

| Field | Format | Required | Description |

|---|---|---|---|

type |

string |

Required | The type of the account. INTERNATIONAL |

accountName |

string |

Required | The name of the account. |

accountNumber |

string |

One of accountNumber or IBAN is required | The account number. See IBAN's and routing codes for more. |

currency |

string |

Required | The currency of the account. |

routingCode |

string |

Optional | The routing code of the account. |

iban |

string |

One of the IBAN or accountNumber is required | The IBAN of the account. |

intermediarySwiftCode |

string |

Optional | The intermediary swift code. |

swiftCode |

string |

Required | The swift code. |

For example

{

"type": "INTERNATIONAL",

"accountName": "Account One",

"currency": "EUR",

"routingCode": "12345",

"iban": "12354678",

"intermediarySwiftCode": "ABC123",

"swiftCode": "WBC12345XXX"

}Australian Domestic and RTGS

| Field | Format | Required | Description |

|---|---|---|---|

type |

string |

Required | The type of the account. AU_DOMESTIC or RTGS. |

accountName |

string |

Required | The name of the account. |

bsbNumber |

string |

Required | The BSB number. |

accountNumber |

string |

Required | The account number. |

For example

{

"type": "RTGS",

"accountName": "Account One",

"bsbNumber": "032-000",

"accountNumber": "100001"

}NZ Domestic

| Field | Format | Required | Description |

|---|---|---|---|

type |

string |

Required | The type of the account. NZ_DOMESTIC |

accountName |

string |

Required | The name of the account. |

bankCode |

string |

Required | The bank code. |

branchCode |

string |

Required | The branch code. |

accountNumber |

string |

Required | The account number. |

accountSuffix |

string |

Required | The account suffix. |

For example

{

"type": "NZ_DOMESTIC",

"accountName": "Account One",

"bankCode": "03",

"branchCode": "2000",

"accountNumber": "100001",

"accountSuffix": "02"

}Payee Registered Address Request Model

| Field | Format | Required | Description |

|---|---|---|---|

street1 |

string |

Required | The street line 1 of the address. |

street2 |

string |

Optional | The street line 2 of the address. |

street3 |

string |

Optional | The street line 3 of the address. |

street4 |

string |

Optional | The street line 4 of the address. |

city |

string |

Optional | The city of the address. |

state |

string |

Optional | The state of the address. |

postcode |

string |

Optional | The postal code of the address. |

countryCode |

string |

Required | The two character country code for the address. |

For example

{

"street1": "Level 1",

"street2": "2 Street St",

"city": "Sydney",

"state": "NSW",

"postcode": "2000",

"countryCode": "AU"

}Payment Response Model

| Field | Format | Description |

|---|---|---|

links |

Array of Links | Links to related documents and resources. |

paymentIdentifier |

string |

The payment identifier used in API calls. |

methodCode |

string |

The code that represents the Payment Method this payment will use. |

statusCode |

string |

The status of the payment. See Payment status codes |

responseCode |

string |

The response code of the transaction after being processed. See Payment response codes |

receiptDescription |

string |

The description of the recponse received for the payment. |

paymentAmount |

decimal |

The amount of the payment. |

payeeName |

string |

The name of the payee of the payment. |

currency |

string |

The currency that the payment was made in. |

recipientReference |

string |

The recipient reference for the payment. This will be the lodgement reference. |

payerReference |

string |

The payer reference for the payment. |

fundingAccount |

A Funding Account Response Model | Represents the funding account for the payment. |

recipientAccount |

A Recipient Account Response Model | Represents the recipient account for the payment. |

payeeRegisteredAddress |

A Payee Registered Address Response Model | Represents the registered address for the payee. |

exchange |

An Exchange Response Model | Represents the exchange information for the payment. This is provided for OTT payments when available. |

For example:

{

"links": [],

"paymentIdentifier": "123456789",

"methodCode": "AU_OTT",

"statusCode": "PAID",

"responseCode": "PROCD",

"receiptDescription": "Payment processed",

"paymentAmount": 100.00,

"paymentDate": "2018-01-15",

"payeeName": "Mrs Payee",

"currency": "AUD",

"recipientReference": "REF_123",

"payerReference": "PAY123",

"fundingAccount": {},

"recipientAccount": {},

"payeeRegisteredAddress": {},

"exchange": {}

}Funding Account Response Model

Australian Accounts

| Field | Format | Description |

|---|---|---|

type |

string |

The type of the account. domestic or international. |

accountName |

string |

The name of the account. |

bsbNumber |

string |

The BSB. |

accountNumber |

string |

The account number. |

traceBsbNumber |

string |

The trace BSB. |

traceAccountNumber |

string |

The trace Account Number. |

currency |

string |

The currency code. |

directEntryUserId |

string |

The Direct Entry User ID of the account. |

directEntryUserName |

string |

The Direct Entry User Name of the account. |

defaultAccount |

string |

Flag to indicate whether this is the default account for this type. true or false. |

remitterDetails |

A Remitter Details Response Model model. | The remitter details of the account. |

For example:

{

"type": "domestic",

"accountName": "Account One",

"bsbNumber": "032-000",

"accountNumber": "100001",

"traceBsbNumber": "032-001",

"traceAccountNumber": "100002",

"currency": "AUD",

"directEntryUserId": "123456",

"directEntryUserName": "DEUSER",

"remitterDetails": {}

}New Zealand Accounts

| Field | Format | Description |

|---|---|---|

type |

string |

The type of the account. domestic or international. |

accountName |

string |

The name of the account. |

bankCode |

string |

The Bank Code. |

branchCode |

string |

The Branch Code. |

accountNumber |

string |

The account number. |

accountSuffix |

string |

The account suffix. |

foreignCurrencyAccountNumber |

string |

The foreign currency account number. |

currency |

string |

The currency code. |

defaultAccount |

string |

Flag to indicate whether this is the default account for this type. true or false. |

remitterDetails |

A Remitter Details Response Model model. | The remitter details of the account. |

For example:

{

"type": "domestic",

"accountName": "Account One",

"bankCode": "03",

"branchCode": "2000",

"accountNumber": "100001",

"accountSuffix": "00",

"currency": "NZD",

"defaultAccount": "true",

"remitterDetails": {}

}Remitter Details Response Model

| Field | Format | Description |

|---|---|---|

remitterName |

string |

The remitter name. |

remitterAddress1 |

string |

The first line of the address. |

remitterAddress2 |

string |

The second line of the address. |

remitterCity |

string |

The remitter city. |

remitterState |

string |

The remitter state. |

remitterPostCode |

string |

The remitter post code. |

remitterCountry |

string |

The remitter country. 2 character ISO country code. |

For example:

{

"remitterName": "Mr Remitter",

"remitterAddress1": "Level 2",

"remitterAddress2": "1 Street St",

"remitterCity": "Sydney",

"remitterState": "NSW",

"remitterPostCode": "2000",

"remitterCountry": "AU"

}Recipient Account Response Model

Different types of recipient accounts include different values.

BPay Account

| Field | Format | Description |

|---|---|---|

type |

string |

The type of the account. BPAY |

currency |

string |

The currency of the account. AUD for BPay. |

billerNumber |

string |

The biller number. |

crn |

string |

The customer reference number of the account. |

For example

{

"type": "BPAY",

"currency": "AUD",

"billerNumber": "123456",

"crn": "12345678"

}International Account

| Field | Format | Description |

|---|---|---|

type |

string |

The type of the account. INTERNATIONAL |

accountName |

string |

The name of the account. |

accountNumber |

string |

The account number. |

currency |

string |

The currency of the account. |

routingCode |

string |

The routing code of the account. |

iban |

string |

The IBAN of the account. |

intermediarySwiftCode |

string |

The intermediary swift code. |

swiftCode |

string |

The swift code. |

For example

{

"type": "INTERNATIONAL",

"accountName": "Account One",

"accountNumber": "123456",

"currency": "EUR",

"routingCode": "12345",

"iban": "12354678",

"intermediarySwiftCode": "ABC123",

"swiftCode": "WBC12345XXX"

}Australian Domestic and RTGS

| Field | Format | Description |

|---|---|---|

type |

string |

The type of the account. AU_DOMESTIC or RTGS. |

accountName |

string |

The name of the account. |

bsbNumber |

string |

The BSB number. |

accountNumber |

string |

The account number. |

currency |

string |

The currency of the account. |

For example

{

"type": "RTGS",

"accountName": "Account One",

"bsbNumber": "032-000",

"accountNumber": "100001",

"currency": "AUD"

}NZ Domestic

| Field | Format | Description |

|---|---|---|

type |

string |

The type of the account. NZ_DOMESTIC |

accountName |

string |

The name of the account. |

bankCode |

string |

The bank code. |

branchCode |

string |

The branch code. |

accountNumber |

string |

The account number. |

accountSuffix |

string |

The account suffix. |

currency |

string |

The currency of the account. |

For example

{

"type": "NZ_DOMESTIC",

"accountName": "Account One",

"bankCode": "03",

"branchCode": "2000",

"accountNumber": "100001",

"accountSuffix": "02",

"currency": "NZD"

}Payee Registered Address Response Model

| Field | Format | Description |

|---|---|---|

street1 |

string |

The street line 1 of the address. |

street2 |

string |

The street line 2 of the address. |

street3 |

string |

The street line 3 of the address. |

street4 |

string |

The street line 4 of the address. |

city |

string |

The city of the address. |

state |

string |

The state of the address. |

postcode |

string |

The postal code of the address. |

countryCode |

string |

The two character country code for the address. |

For example

{

"street1": "Level 1",

"street2": "2 Street St",

"city": "Sydney",

"state": "NSW",

"postcode": "2000",

"countryCode": "AU"

}Exchange Response Model

| Field | Format | Description |

|---|---|---|

exchangeRate |

decimal |

The exchange rate of the payment. |

exchangeReference |

string |

The exchange reference code of the payment. |

fundingAmount |

decimal |

The funding amount of the payment. |

fundingCurrency |

string |

The funding currency of the payment. |

For example

{

"exchangeRate": "0.0001",

"exchangeReference": "ABC123",

"fundingAmount": "100",

"fundingCurrency": "AUD"

}Payment Methods

The following are the payment methods available in the PaymentsPlus API.

| Method Code | Method Name |

|---|---|

DIRECT_ENTRY |

Australian Direct Entry Payment (EFT) |

RTGS |

Australian Real Time Gross Settlement Payment |

BPAY |

Australian BPay Payment |

AU_OTT |

Australian Overseas Telegraphic Transfer |

NZ_DIRECT_ENTRY |

New Zealand Direct Entry Payment |

NZ_OTT |

New Zealand Overseas Telegraphic Transfer |

File Status Codes

| Code | Description |

|---|---|

OPEN |

The file is open and can have payments added to it. See Create Payment. |

PENDING |

The file has been loaded successfully and is scheduled to be sent. |

FORMAT_CHECK |

The format of the file file is being checked for errors. |

VALIDATED |

The file has been validated. |

ERROR |

Errors were found in the file. Errors will be returned with the file details. |

AUTHORISATION_REQUIRED |

The file is awaiting authorisation. This is performed through the PaymentsPlus portal. |

SECOND_AUTH_REQUIRED |

The file is awaiting a second authorisation. This is performed through the PaymentsPlus portal. |

CANCELLED |

The file has been cancelled and will not be processed. |

PROCESSING |

The file is currently processing, and the payments have been submitted to the bank. |

COMPLETE |

The file is complete and the status of the payments has been returned. |

POSSIBLE_DUPLICATE |

The file has been flagged as a duplicate and should be checked. This is performed through the PaymentsPlus portal. |

File Receipt Status Codes

| Code | Description |

|---|---|

null |

The payments in the file have not yet been submitted. This may be because there are errors in the file, or it is still in an open state. |

AWAITING_CLEARANCE |

The payments have been submitted to the bank and are awaiting confirmation of their status. Files may remain in this status for different periods of time depending on the type of payments in the file. |

COMPLETE |

The receipt status of all payments in the file has been receieved. |

Payment Status Codes

| Code | Description |

|---|---|

OPEN |

The payment is in an open state and can be modified or cancelled. See Create Payment. |

PENDING |

The payment has been process and is scheduled to be sent. |

CANCELLED |

The payment has been cancelled and will not be processed. |

PROCESSING |

The payment is currently processing and has been sent to the bank. |

PAID |

The payment was paid successfully. |

FAILED |

The payment was rejected. See Payment response codes |

PRE_PAYMENT_FAILED |

The payment was rejected during validation. |

null |

The payments in the file have not yet been submitted. This may be because there are errors in the file (File Status Code ERROR) , is still in an open state (File Status Code OPEN), or it has otherwise not yet been submitted (any of the other File Status Codes, except PROCESSING and COMPLETE). |